According to media reports, investors are pouring money into platinum-related funds at the fastest pace in four years, betting on renewed interest in hybrid vehicles and solid demand for traditional internal combustion engine cars.

Data shows that in the second quarter, holdings in physical platinum-backed exchange-traded funds (ETFs) surged by about 444,000 ounces, equivalent to around 6% of annual demand, marking the largest quarterly increase since 2020.

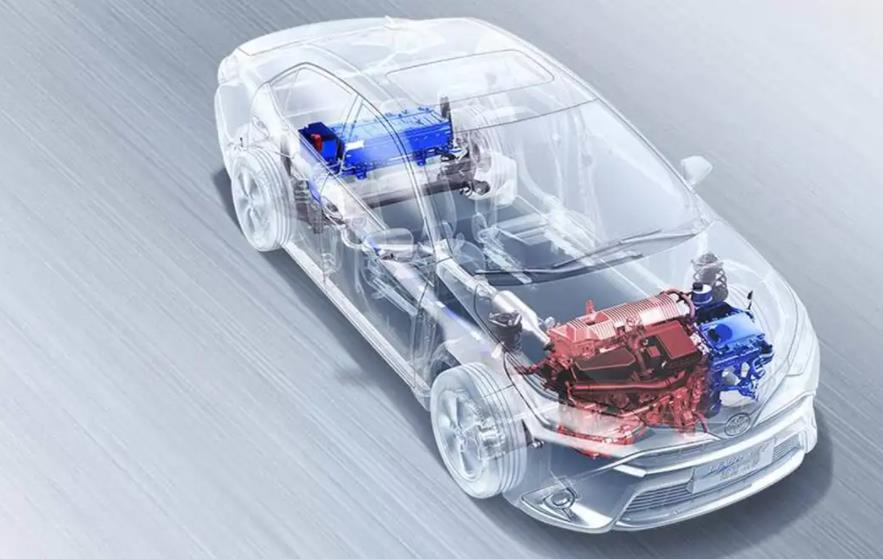

Platinum is commonly used in automotive emission systems as a catalyst to convert harmful substances in exhaust gases into harmless substances. Thus, both hybrid and traditional internal combustion engine cars use platinum to reduce harmful emissions.

In recent years, as consumer caution towards pure electric vehicles has increased, sales of hybrid vehicles have surged, and major automakers are once again heavily investing in this field. These companies also expect that fuel cars will remain in use longer than previously anticipated.

Edward Sterck, Director of Research at the World Platinum Investment Council, stated, “Investor interest stems from slowing battery electric vehicle growth and higher demand for fuel cars. Hydrogen energy is also a major highlight for platinum’s future development.”

Since the beginning of the year, the spot price of platinum has mostly remained below $1,000 per ounce, only stabilizing above this level in recent months. Analysts noted that some investors who profited from trading gold are now transferring funds into other precious metals like silver and platinum.

Nitesh Shah, Head of Commodities Research at WisdomTree, which offers platinum ETFs, stated, “Gold and silver prices have risen sharply, and people expect platinum to be the next to rise.” Year-to-date, ETFs linked to palladium have also seen strong inflows, equivalent to 200,000 ounces.

For traditional automakers like Ford and Stellantis, investing in hybrid technology is much less costly compared to pure electric vehicles and can generate higher profit margins. Toyota, the world’s leading car manufacturer by delivery volume, continues to bet on internal combustion engines and hybrid models.

Against this backdrop, data from BNP Paribas shows that hybrid vehicle sales in Europe surged by 21% this year to 1.3 million units, while electric vehicle sales grew only 2%. In contrast, hybrid vehicle sales in the U.S. increased by 35% year-on-year.

Jefferies analyst Philippe Houchois stated, “Everything is different from a year ago. Some manufacturers who originally decided to stop production are now re-adding hybrid models to their catalogs. Hybrid vehicles have a long lifespan, and plug-in hybrids have an even longer lifespan.”

Houchois added, “They all require catalytic converters.” Catalytic converters, which are part of a car’s exhaust system, reportedly contain higher amounts of platinum and palladium in hybrid vehicles compared to traditional gasoline and diesel engines.

Meanwhile, the slowing demand for electric vehicles has impacted the prices of battery metals like lithium, cobalt, and nickel. Nicky Shiels, an analyst at Swiss precious metals refiner and trader MKS Pamp, stated that the slowdown in electric vehicles is a complete tailwind for platinum investment demand.

Paul Syms, Head of Commodity Product Management at Invesco, stated that platinum demand will also be boosted by artificial intelligence and data storage, as the metal is used in hard disk drives (HDDs), and supply is expected to remain low.

[Source – 上海有色网] 混合动力汽车销量大涨带动需求 这一贵金属的投资剧增! https://news.smm.cn/news/102848960